Debt Relief vs. Debt Consolidation:

What’s the Difference?

We’re Not a Debt Relief Company—We’re Your Financial Freedom Partner

Published on 02/12/2025

What is Debt Relief?

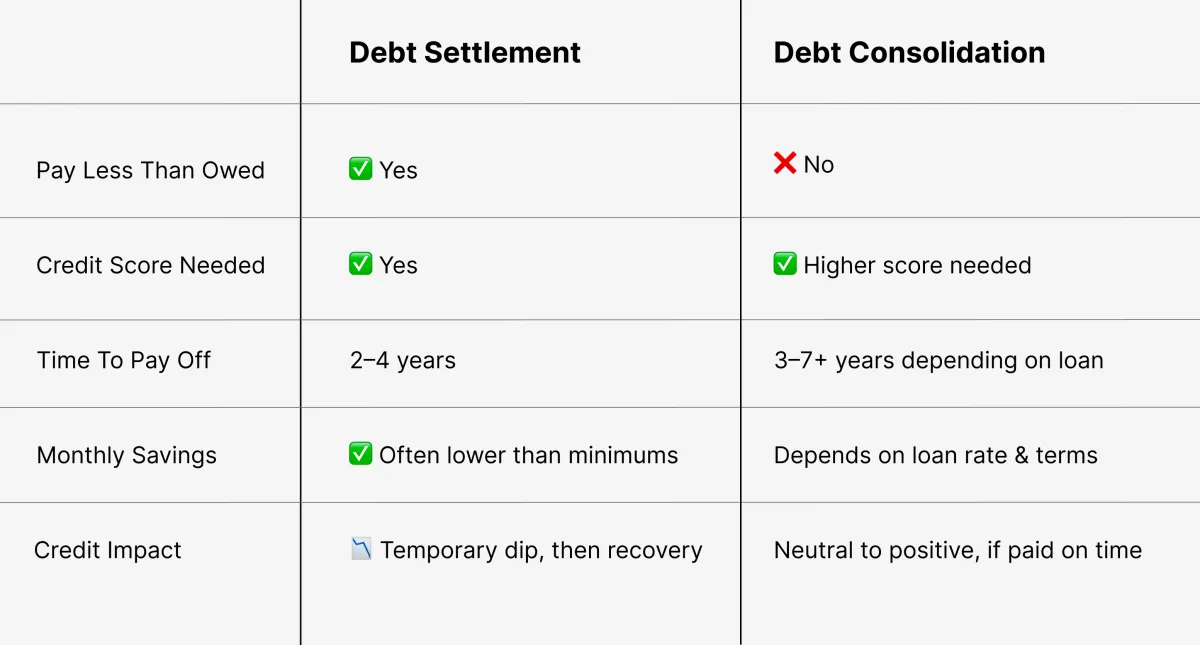

Debt relief is a broad term that includes options like debt settlement and debt consolidation. Both help reduce your financial burden, but they work in different ways.

What is Debt Settlement?

Debt settlement is a legal process where a professional team negotiates with your creditors to reduce the total amount you owe. Instead of paying back the full balance (which includes years of interest), you settle the debt for a lower amount—usually in one structured plan over 24 to 48 months.

How It Helps:

– Lower Total Payoff: You pay less than what you owe.

– Faster Resolution: Most programs finish in 2 to 4 years.

– Fewer Interest Charges: Because accounts are negotiated and paid down.

– Relief From Monthly Strain: Plans are often more affordable than minimum payments.

Is It Right For Everyone?

Debt settlement is ideal for people with over $10,000 in unsecured debt (like credit cards) who are struggling to make real progress. It may temporarily impact your credit, but most clients see their scores recover as their balances go down and accounts are resolved.

What is Debt Consolidation?

Debt consolidation means combining multiple debts—usually credit cards—into one new loan. The goal is to simplify payments and reduce your interest rate.

How It Helps:

– One Monthly Payment: Easier to manage.

– Lower Interest (If You Qualify): Based on your credit score.

– No Creditor Negotiation Needed

What to Consider?

–You’ll still pay back the full amount you owe.

– A higher credit score is usually required to get a good rate.

– You could end up paying more in the long run if terms are long or interest isn’t low enough.

WHAT TO CONSIDER:

How Do You Know If Debt Relief Is the Right Move?

If any of the following sound like you, debt relief may be a powerful first step to rebuild your financial life:

– You’re paying more in interest each month than you’re saving.

– Your credit score is under 750, and you're not seeing it improve.

– You have less than 3 months of personal savings to fall back on.

If that sounds familiar, then debt relief isn't just a good idea—it’s a smart, proactive move to stop the bleeding and take control. It’s not about failure. It’s about freedom. Let’s talk about how to pursue yours.

FREE Consultation

Book A Discovery Call

Pursue Freedom

Contact:

© Copyright 2025, Pursue Freedom

All rights reserved.