CASE STUDY:

How Tom Saved $33,923

Published on 04/02/2025

Meet Tom Andies.

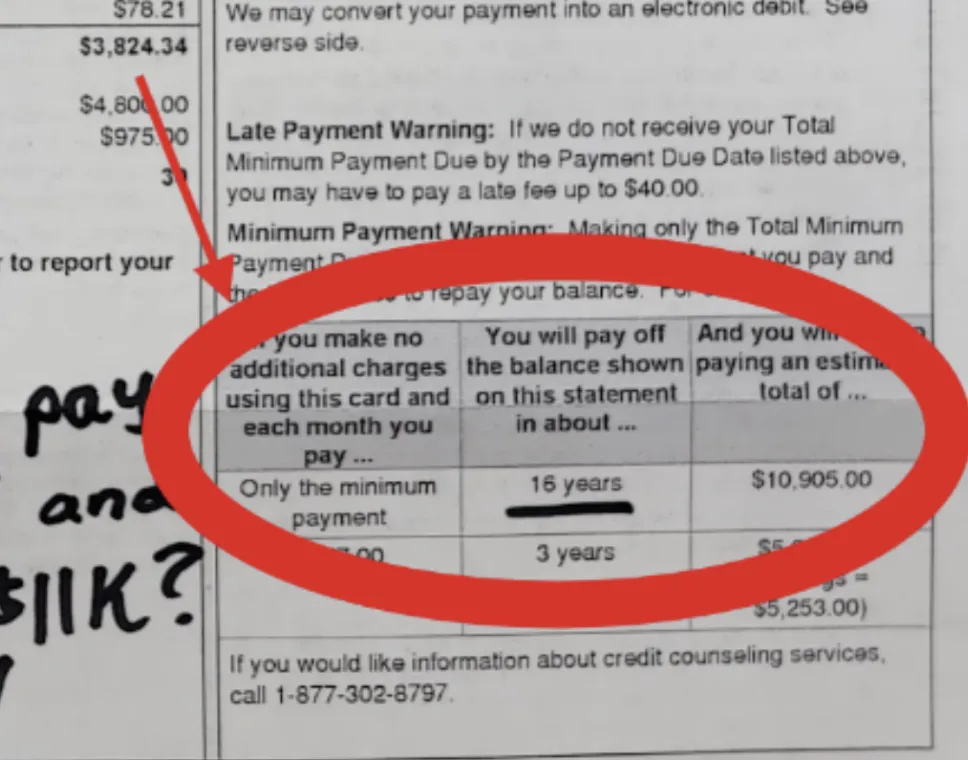

At 34 years old, Tom was managing a steady job, paying his bills on time, and staying current on his credit card payments. But despite sending $746 toward his cards every month, he wasn't making any real progress. His total credit card debt sat at $22,97, and the balances barely moved month to month.

Most of Tom’s payments were going towar interest charge, not the principal. When he reviewed his situation more closely, he realized that if he kept making only minimum payments, it would take him over 20 years to pay off the full amount. In the process, he would have paid more than $32,500 in interest alone.

Total cost over 20 years:

$55,475

Interest alone:

$32,500

At the same time, Tom's credit score was declining because his cards were close to being maxed out — a factor that weighs heavily on credit scores, even if payments are made on time.

Finding a Smarter Option

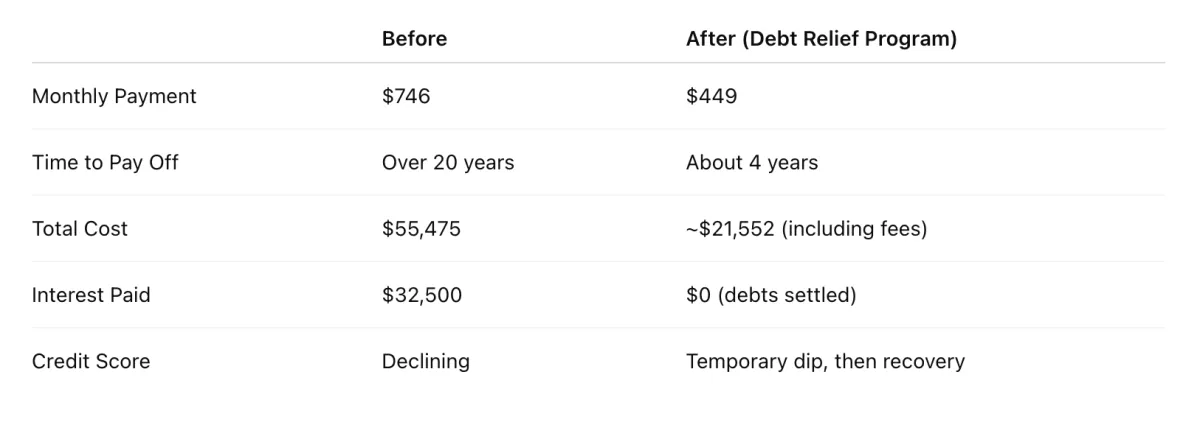

After researching his options, Tom enrolled in a structured debt relief program through Pursue Freedom. Instead of continuing minimum payments to his credit cards, he began setting aside $449 per month in a dedicated account. Those funds were then used to settle his debts for less than the original balances.

Here’s how Tom’s numbers changed:

What Tom Traded — and What He Gained

To complete the program, Tom had to agree to a few important changes:

– He stopped using his credit cards.

– His credit score dipped temporarily due to the nature of settlement.

In exchange, Tom:

– Cleared $23,000 in debt in about four years.

– Saved more than $33,000 compared to making minimum payments.

– Reduced his monthly outflow by nearly $300, which he could redirect toward savings after completing the program.

– Created a clear timeline for becoming debt-free, instead of staying stuck in minimum payments for two decades.

Longer-Term Benefits

By lowering his monthly payments and eliminating his high-interest debt much faster, Tom also set himself up for better financial stability over the next decade.

For example:

– If he had stayed on the minimum payment track, he might have saved only about $6,000 in 10 years.

– With debt relief and lower monthly obligations, Tom could save over $21,000 during the same period — a major difference that improves his financial flexibility.

FREE RESOURCES

Learn More In Our Graduates Resource Library

FREE Consultation

Book A Discovery Call

Pursue Freedom

Contact:

© Copyright 2025, Pursue Freedom

All rights reserved.