Debt Relief Better Than Bankruptcy? And Can It Help You Avoid Filing?

Published on 04/17/2025

FAQ: Is debt relief a better option than bankruptcy?

Can it help me avoid filing?

Great question—and one that comes up often when people feel like they’re out of options.

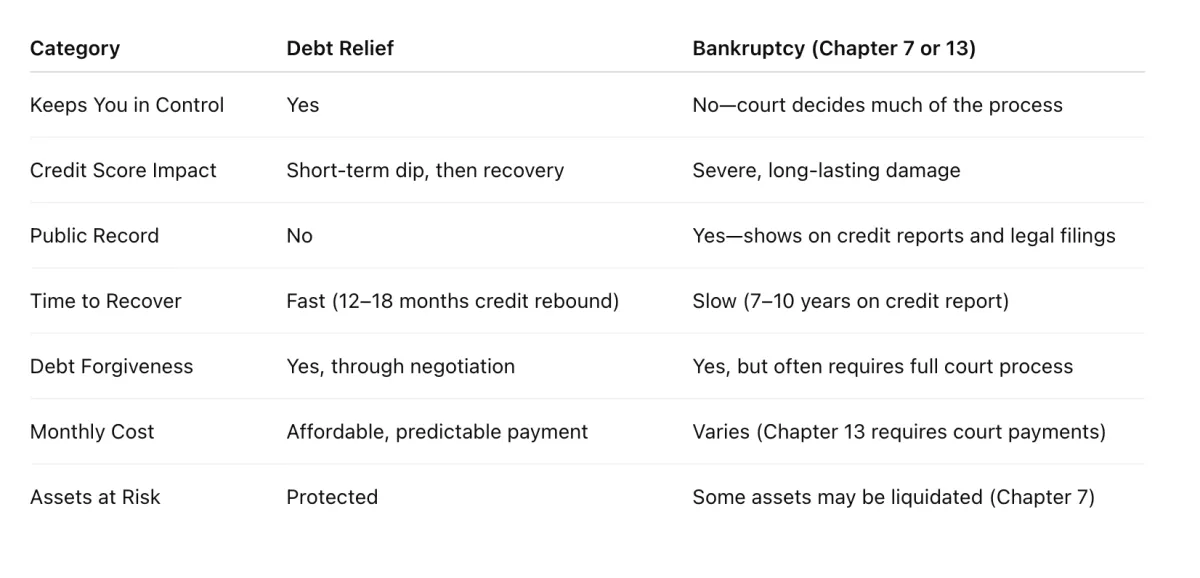

While every situation is different, here’s a clear and simple way to understand the differences.

How Debt Relief Helps You Avoid Bankruptcy

Debt relief programs are often the step before bankruptcy—a way to resolve unmanageable debt without legal action or public record.

Here's how it helps:

– Creditors settle for less than you owe, avoiding lawsuits and collections

– You can stop relying on minimum payments that aren’t working

– You regain monthly cash flow to cover essentials and rebuild savings

– You avoid court fees, legal costs, and the long-term credit hit of bankruptcy

Many people who think they need bankruptcy actually qualify for a structured debt relief plan that gets them back on track in 2–4 years—without the stigma and damage of a bankruptcy filing.

When Bankruptcy Might Be a Better Option:

Bankruptcy is sometimes the right call if:

– You have no income or ability to make any payment

– Your debts are extremely high compared to your income

– You’re already facing lawsuits, wage garnishments, or judgments

Even then, it’s worth reviewing a debt relief option first—because once you file, it’s permanent.

The Bottom Line

Debt relief is not a shortcut or a gimmick. It’s a legal, proven way to settle your debt, avoid bankruptcy, and take control of your finances again.

If you:

– Can make a monthly payment (just not the full minimums)

– Want to avoid court, public records, and long-term damage

– Need a fresh start without losing your assets

Then debt relief may be the smarter choice.

Let us walk you through it. The right plan could be just one decision away.

You don’t have to hit rock bottom to take your power back.

FREE RESOURCES

Learn More In Our Graduates Resource Library

FREE Consultation

Book A Discovery Call

Pursue Freedom

Contact:

© Copyright 2025, Pursue Freedom

All rights reserved.