How to Rebuild Your FICO Score Using Debt Relief—and Why It Works

Published on 04/17/2025

One of the most common questions we get:

How does debt relief affect my FICO score, and can it actually help me rebuild it faster than other options?

Great question—and one we hear a lot.

The truth is, your FICO score is shaped by a few key factors, and debt relief—when done the right way—can help fix the ones that matter most.

The 3 Most Important Parts of Your Credit Score

1. Payment History (35%)

Lenders want to see that you pay on time.

2. Credit Utilization (30%)

This is how much of your available credit you're using. High balances = lower score.

3. Length of Credit History + Mix + New Credit (35%)

Less impact, but still important.

How Debt Relief Helps Improve These Areas:

Credit Utilization Goes Down

One of the fastest ways to boost your score is to lower your balances. Debt relief helps you settle and pay off high-balance cards, reducing utilization—and that lifts your score.

Total Debt Drops Fast

Instead of just paying interest, you’re knocking out your balances. This changes your debt-to-income (DTI) ratio and makes you look like a lower-risk borrower.

Structure = Recovery

Unlike ongoing minimum payments or juggling personal loans, debt relief gives you a clear timeline, a predictable monthly cost, and real progress every month.

But Doesn’t Debt Relief Hurt My Credit?

Yes, there’s a short-term dip—mostly because your accounts stop reporting “current.”

But here’s what matters:

If your cards are maxed out, your score may already be declining.

If you’re only making minimums, your utilization stays high—which keeps your score stuck.

In a debt relief plan, your balances shrink fast. That’s what drives long-term recovery.

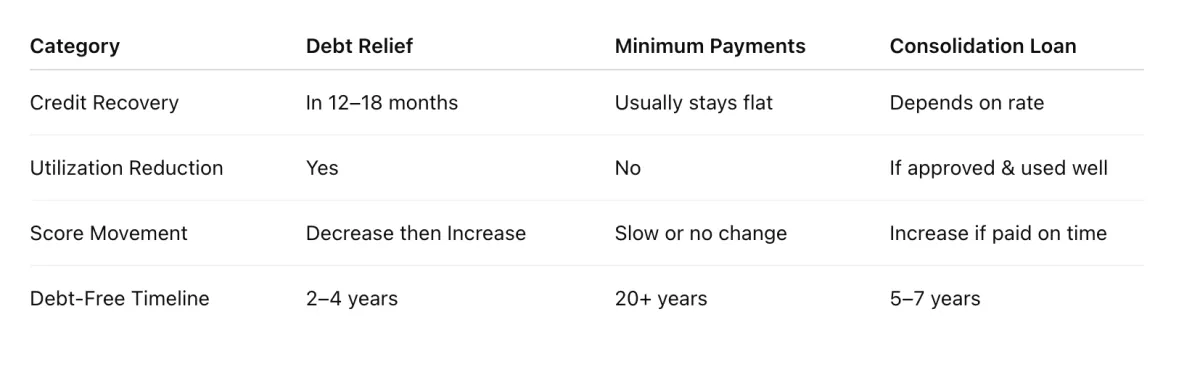

Most clients begin seeing score recovery within 12–18 months—faster than those who stay stuck in long-term minimum payments.

Why This Matters for Your Future:

If you want to qualify for a home, car, or business loan in the next 3–5 years, your score and debt-to-income ratio must improve.

Debt relief helps you:

– Drop your utilization

– Lower your total debt

– Rebuild your score over time

– Free up money to build savings

All of which lenders love.

Bottom Line: You can’t rebuild your credit if you stay stuck in debt. Debt relief creates the space to recover, rebuild, and move forward.

Make today the day you start.

FREE RESOURCES

Learn More In Our Graduates Resource Library

FREE Consultation

Book Your Discovery Call

Pursue Freedom

Contact:

© Copyright 2025, Pursue Freedom

All rights reserved.